🚀 TL;DR

- Most solopreneurs know they are undercharging, but fear inconsistent demand more than they doubt their own value.

- The pricing gap is not a confidence problem—it’s a pipeline and leverage problem disguised as hesitation.

- Retainers and high close rates often suppress pricing power by anchoring value to time and availability.

- Experience alone does not fix pricing; it often makes raising rates feel riskier due to accumulated opportunity cost.

- Sustainable pricing increases come from stronger demand systems, clearer positioning, and outcome-based offers—not mindset work alone.

I’ve been mentoring entrepreneurs, consultants, and solopreneurs for longer than I care to admit. And in nearly every conversation about pricing, the same pattern shows up. They know they’re undercharging. They’ve known for a while.

But they haven’t changed it.

Not because they lack confidence in their work. Not because they’re unsure of the results they deliver. The hesitation runs deeper than that—and it’s rarely what people assume.

So I decided to find out what’s actually going on.

I surveyed solopreneurs across my network to get first-party data. The survey participants included:

- Consultants

- Fractional executives

- Agency founders

- Coaches

- Freelance specialists

I didn’t just ask what they charge. I asked what they want to charge and what’s stopping them from doing so. And the answers were revealing:

- 92% of solopreneurs want to charge more than they currently do. Only 8% said they’re close to where they want to be.

- 49% of solopreneurs believe they’re underpricing, and another 38% aren’t sure.

- Combined, that’s 87% who don’t fully trust their own rates.

And yet, the average confidence in pricing was 6.7 out of 10. Not low. So it’s not about crippling self-doubt, but rather inconsistency in their pipeline.

In other words, solopreneurs aren’t afraid of their own value. They’re afraid of where the next client will come from.

This report breaks down my top 10 findings from the solopreneur pricing survey, along with an under-the-hood look at how you can price your services better in 2026.

1. Almost no solopreneur is priced where they want to be

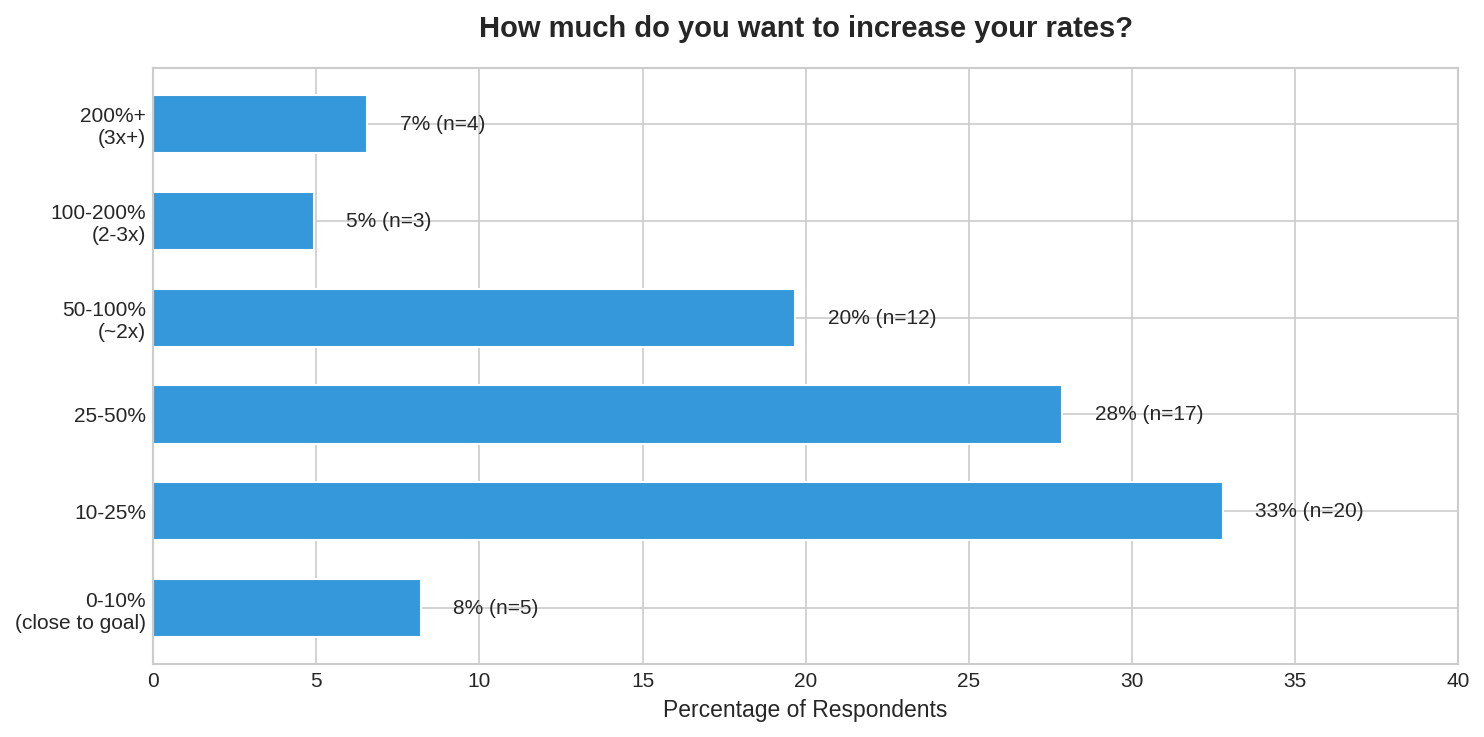

I asked respondents a simple question: If you felt fully positioned, confident, and had the right clients, by how much would you want to increase your rates?

Only 8% said they’re close to where they want to be.

The rest broke down like this:

- 33% want a 10-25% increase

- 28% want a 25-50% increase

- 20% want to roughly double their rates (50-100%)

- 11% want to 2x or 3x+ their rates

That’s 92% of solopreneurs who believe they should be charging more than they currently do. They don’t want to make a small adjustment to cover the cost of inflation, but they’re too close to closing a meaningful gap between where they are and where they belong.

And this isn’t wishful thinking. These are experienced operators: 67% have been in business for three or more years. They’ve closed deals, delivered results, and built reputations. They’re not guessing at their value. They haven’t captured it yet, and they’re aware of it.

|

💡 How to fix this? Start by quantifying the gap. If you want a 25–50% increase, that’s not abstract—it’s a specific number. Calculate what your rates would look like at +25%, +50%, and +100%.

Then ask yourself: What would need to be true about my positioning, my clients, or my offer for that number to feel reasonable? The gap becomes less intimidating when you break it into concrete variables you can actually work on. |

2. Almost 50% of solopreneurs believe they’re underpricing—and most of the rest aren’t sure

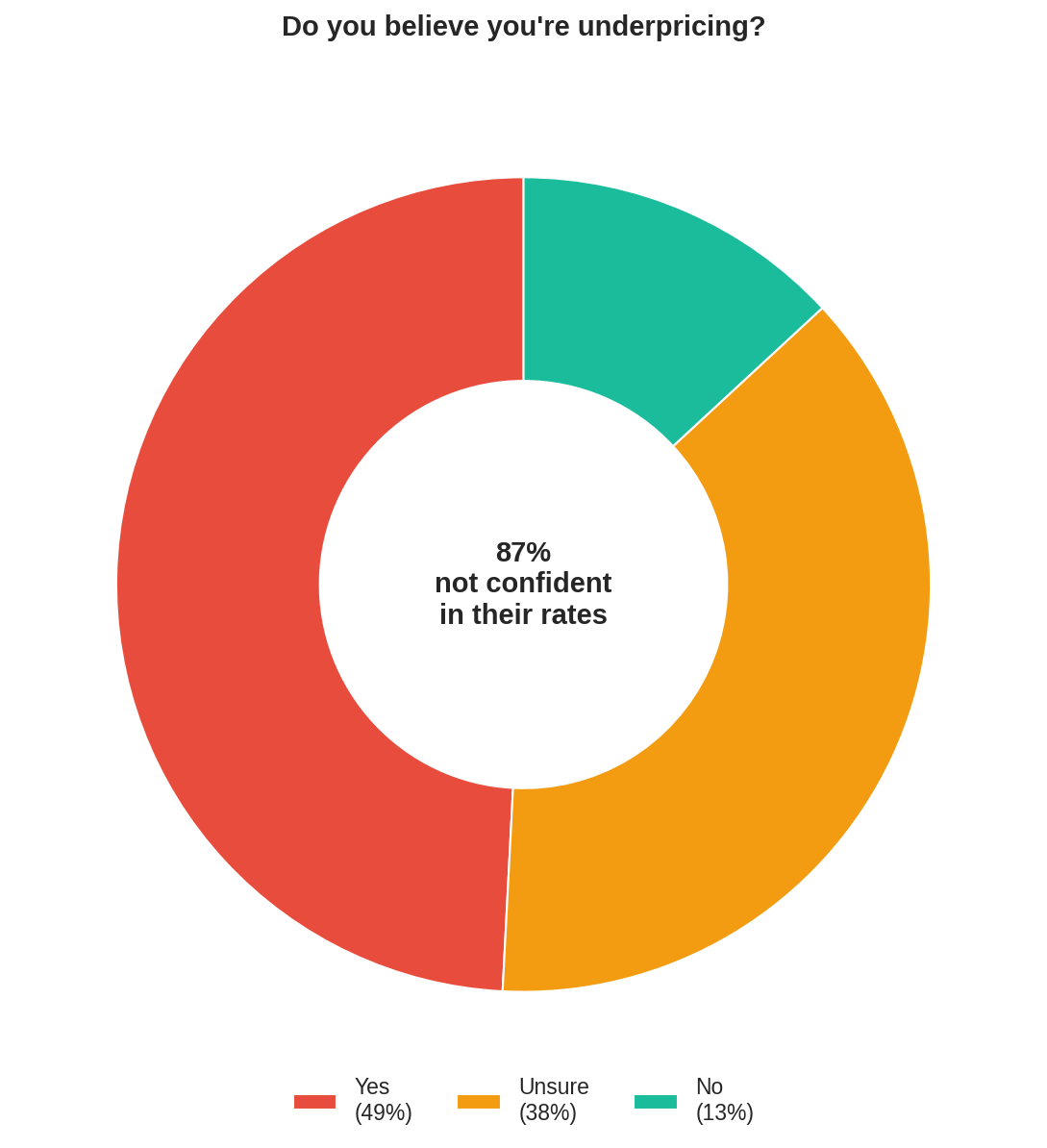

When asked directly whether they’re underpricing their services, responses fall into three categories.

- 49% said yes. They believe they’re leaving money on the table.

- 38% said they’re unsure. Not confident either way, but it’s its own kind of signal.

- 13% said no. They feel their pricing is right.

Add the first two together, and you get 87% of solopreneurs who don’t fully trust their own rates. That’s not a confidence crisis in the traditional sense. It’s a calibration problem. People sense something is off, but they don’t have the data or the framework to know for sure.

I’ve seen this with my clients as well. They’re often too close to the problem, suffer from tunnel vision, and can’t see exactly why they’re unable to raise rates. They might feel it’s the market or insecurity in their own skills, but sometimes it’s much more than that.

| 💡 How to fix this? Get external calibration. If you’re unsure whether you’re underpricing, you probably are. Talk to peers at your level, ask clients what they expected to pay before they saw your rates, or audit competitors who serve similar clients. You need to gather data points that challenge your assumptions. |

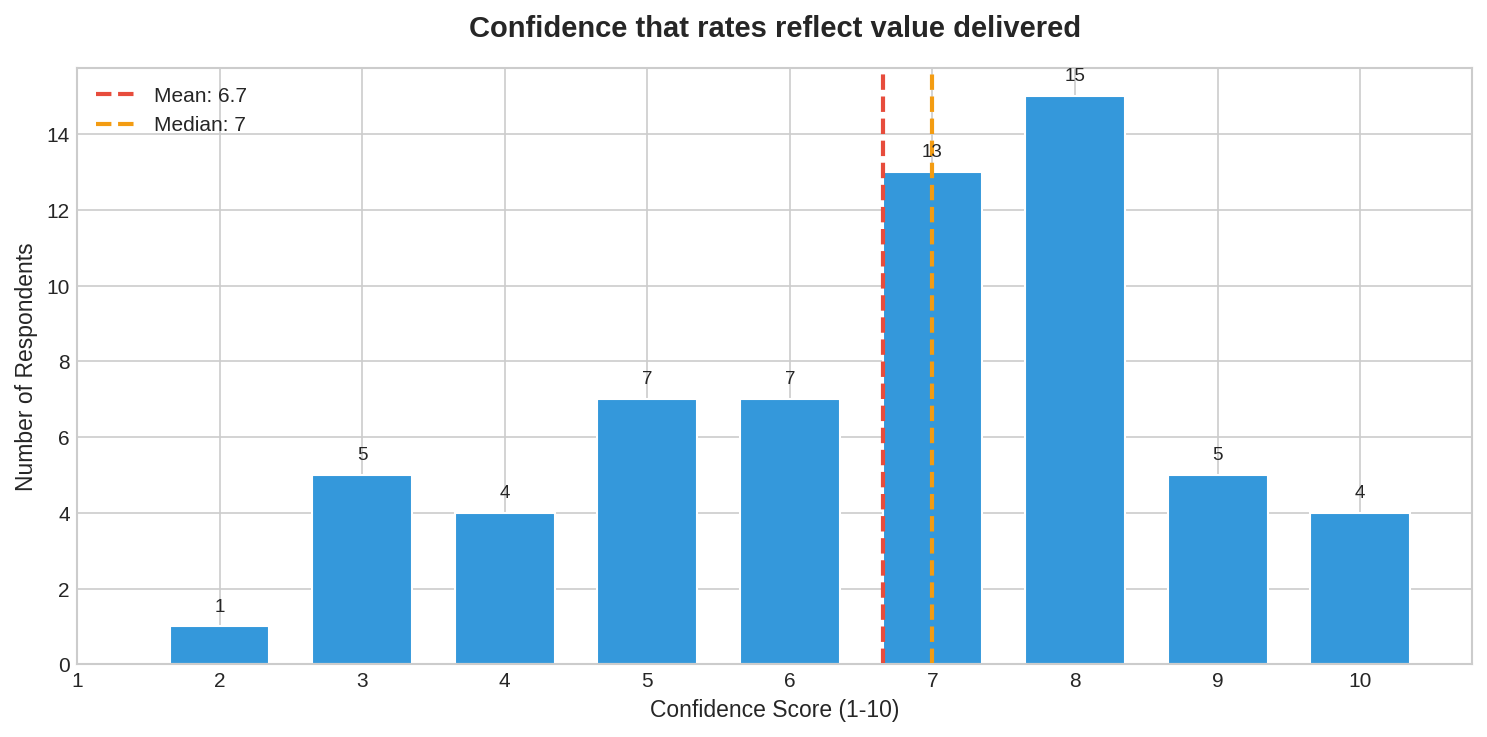

3. Most solopreneurs are confident that their rates reflect the value offered

If so many solopreneurs believe they’re underpriced, you’d expect confidence to be in the gutter.

It’s not.

In fact, the average confidence that current rates reflect the value delivered is 6.7 out of 10. Over 60% of respondents rated themselves 7 or higher.

That’s...surprisingly decent.

So what’s going on? How can people feel reasonably confident in their pricing and believe they should be charging 25-50% more?

The answer is that confidence and action aren’t the same thing. I’ve seen this time and time again. Most solopreneurs aren’t always paralyzed by self-doubt. They believe in their work. What they don’t trust is the system around them—their positioning, offer, and the possibility of the next opportunity walking through the door.

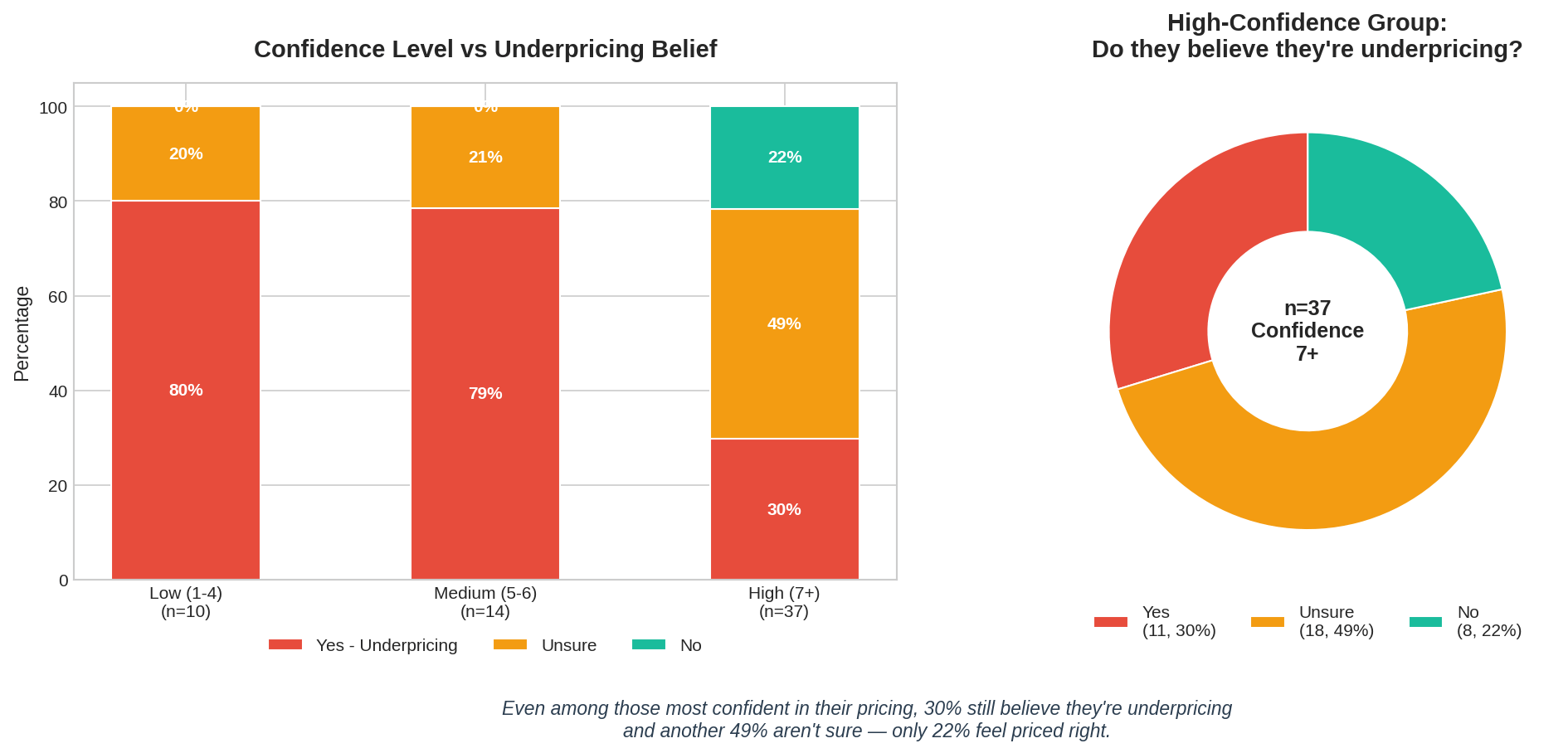

It’s expected that those who have low confidence that their service offers value will also feel they’re underpricing. But the interesting part is that the respondents who rated their confidence 7 or higher, 30% still said they believe they’re underpricing. That’s 30% of the high-confidence group. They’re not uncertain about their value.

They’re uncertain about whether the market will reward it. And therein lies the problem for most solopreneurs who’ve been in business for more than a minute.

| 💡 How to fix this? Test your pricing in low-risk ways: raise rates for new clients only, introduce a premium tier alongside your current offer, or quote 20% higher on your next proposal and see what happens. You need a small experiment that generates real data. |

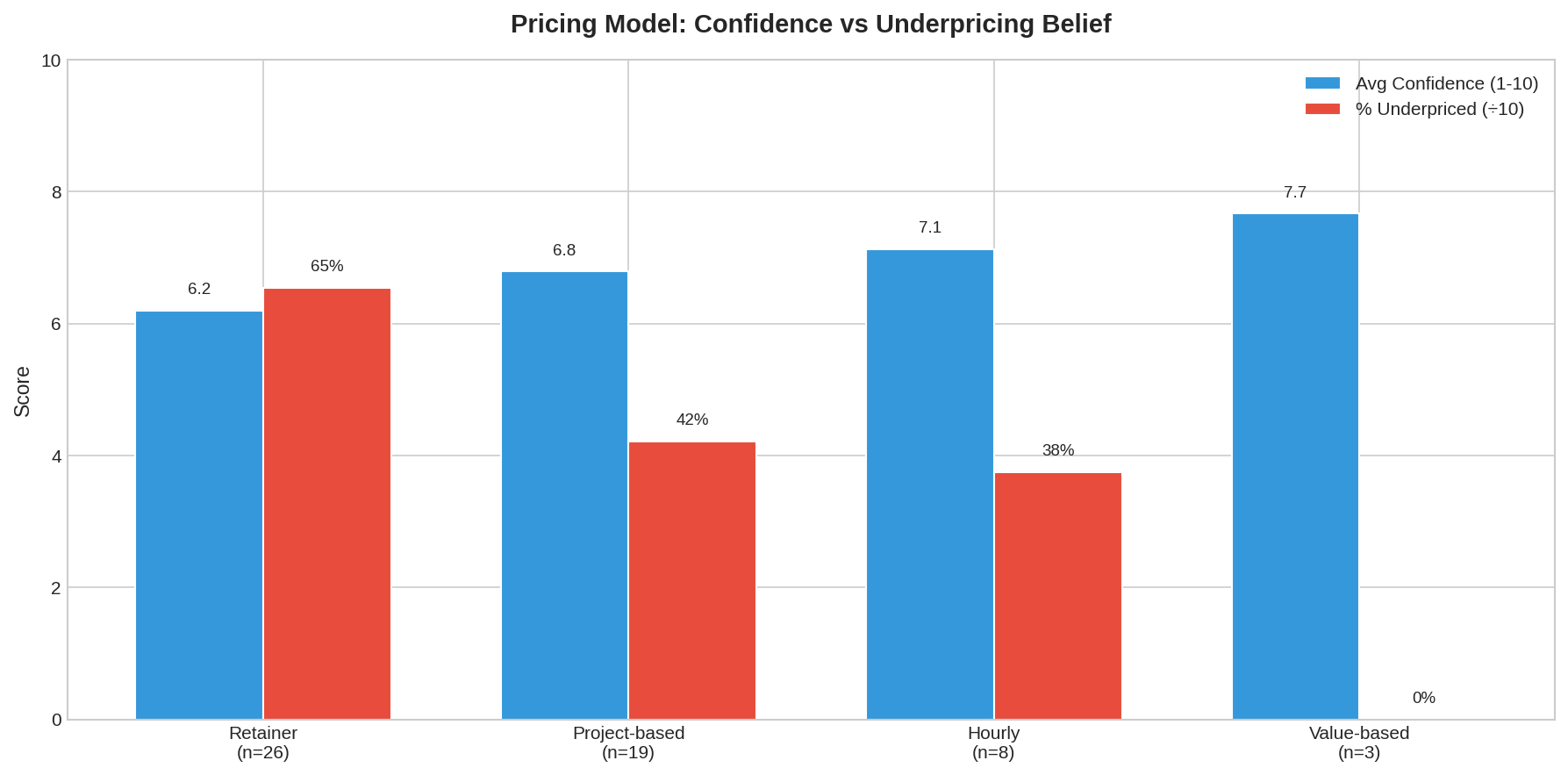

4. Retainers are the most common model, but it creates the most tension

Pricing model shapes more than revenue. It shapes how you feel about your rates.

Retainers dominate this sample: 43% of respondents use ongoing monthly engagements as their primary model, project-based pricing comes second at 31%, and hourly pricing comes third at 13%.

But popularity doesn’t mean satisfaction.

Retainer users reported the lowest average confidence (6.2 out of 10) and the highest rate of underpricing belief. In fact, 65% of solopreneurs who use the retainer model say they’re charging too little, compared with 38% of hourly billers and 42% of project-based billers.

The respondents using value-based or outcome-based pricing? Zero percent believed they were underpricing. They also showed a high level of confidence, although the sample size is too small to draw firm conclusions.

That said, it is a small sample, but a pattern I see with my mentorship clients. They believe retainers are safer because of recurring revenue, but they anchor your pricing to time and availability.

When clients pay monthly, they tend to think in terms of “hours available” or “tasks completed”—not outcomes delivered. You become a line item on their budget, comparable to software subscriptions or part-time employees. That comparison kills your pricing power. It’s hard to justify a rate increase when the client’s mental model is “I’m buying access to your time” rather than “I’m buying a result.”

|

💡 How to fix this? Use offer-based or outcome-based pricing.

Offer-based or outcome-based pricing flips the conversation. You’re not selling hours or access—you’re selling a result. The discussion shifts from “How much do you cost?” to “What’s this worth?” which is a completely different negotiation. That’s why I push solopreneurs to move away from retainers toward structured, scalable offers with clear outcomes. |

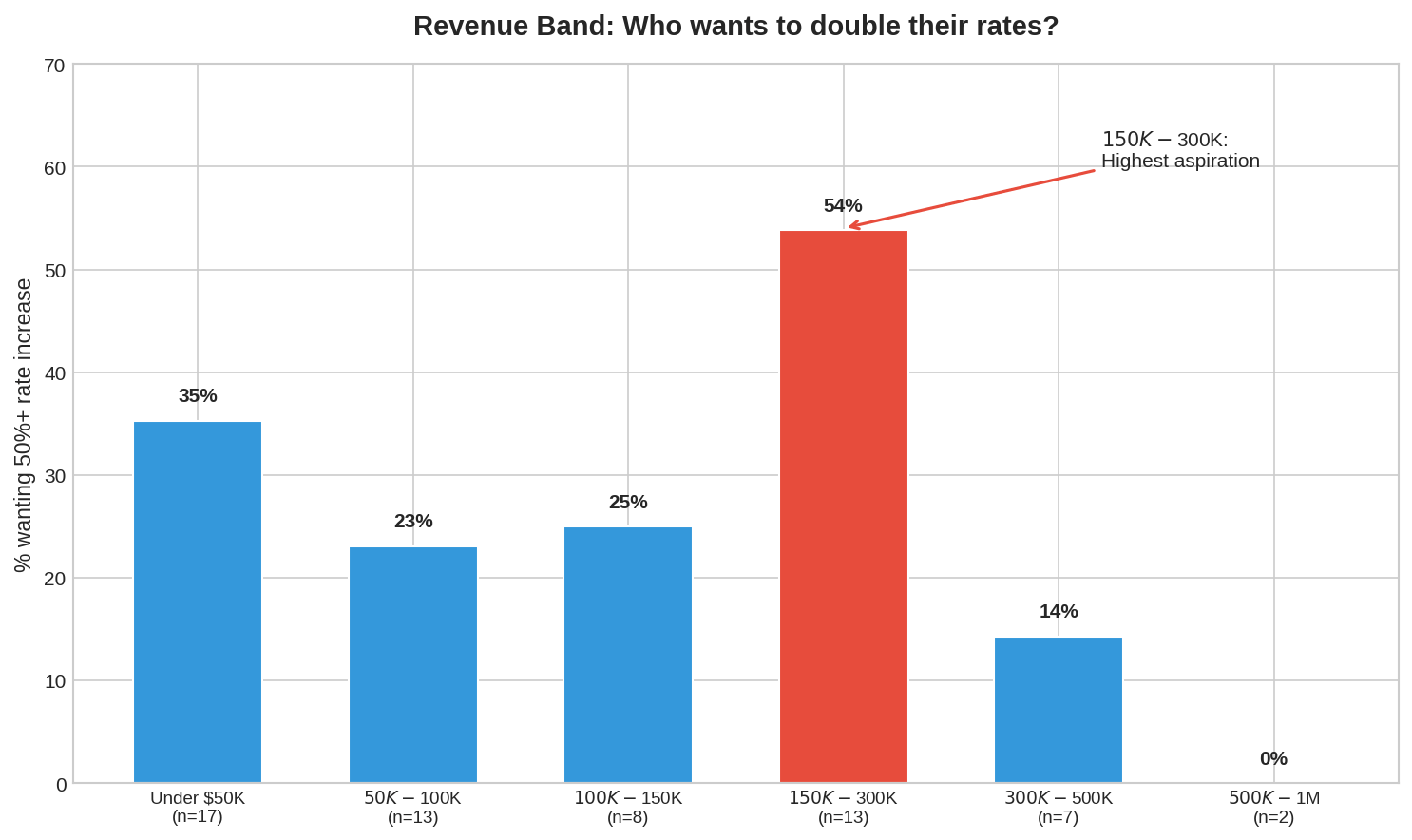

5. The 6-figure earners want to double their rates more than the 5-figure earners

Revenue level tells a story about where pricing dissatisfaction lives.

At first glance, you’d expect the lowest earners to feel most underpriced. And they do so because 65% of those earning under $50K annually believe they’re leaving money on the table.

But the most ambitious cohort isn’t at the bottom. It’s in the middle.

Among solopreneurs earning $150K-$300K every year, 54% want to increase their rates by 50% or more. That’s the highest of any revenue band. It’s not that they’re struggling, but they’re actually thriving, according to the consensus on what a “successful solopreneur” means. But this cohort also knows there are many opportunities within the business to optimize operations and increase revenue.

Meanwhile, those in the $300K-$500K range show a different pattern: 57% feel underpriced, but only 14% want a 50%+ increase. They’ve made peace with incremental gains and will continue to close that gap by pulling the right pricing levers.

But the $150K-$300K group hasn’t yet, and they’re gunning to reach the higher revenue band. They see the ceiling clearly but just haven’t broken through it yet.

Why does this cohort feel the most stuck? They’ve proven the model works. They’re not struggling to find clients or deliver results. But they’ve also hit the limits of how they originally built the business—often with pricing, positioning, or offers designed for an earlier stage. What got them to $150K won’t get them to $300K. The playbook needs to change.

|

💡 How to fix this? If you’re in this revenue band, audit your client mix. Are you serving the same type of clients you started with, just more of them? That’s a volume play, and it caps out fast.

The path forward usually involves moving upmarket (larger clients, bigger budgets), restructuring your offer (higher price, more leverage), or narrowing your positioning (becoming the obvious choice for a specific problem). Pick one and commit. |

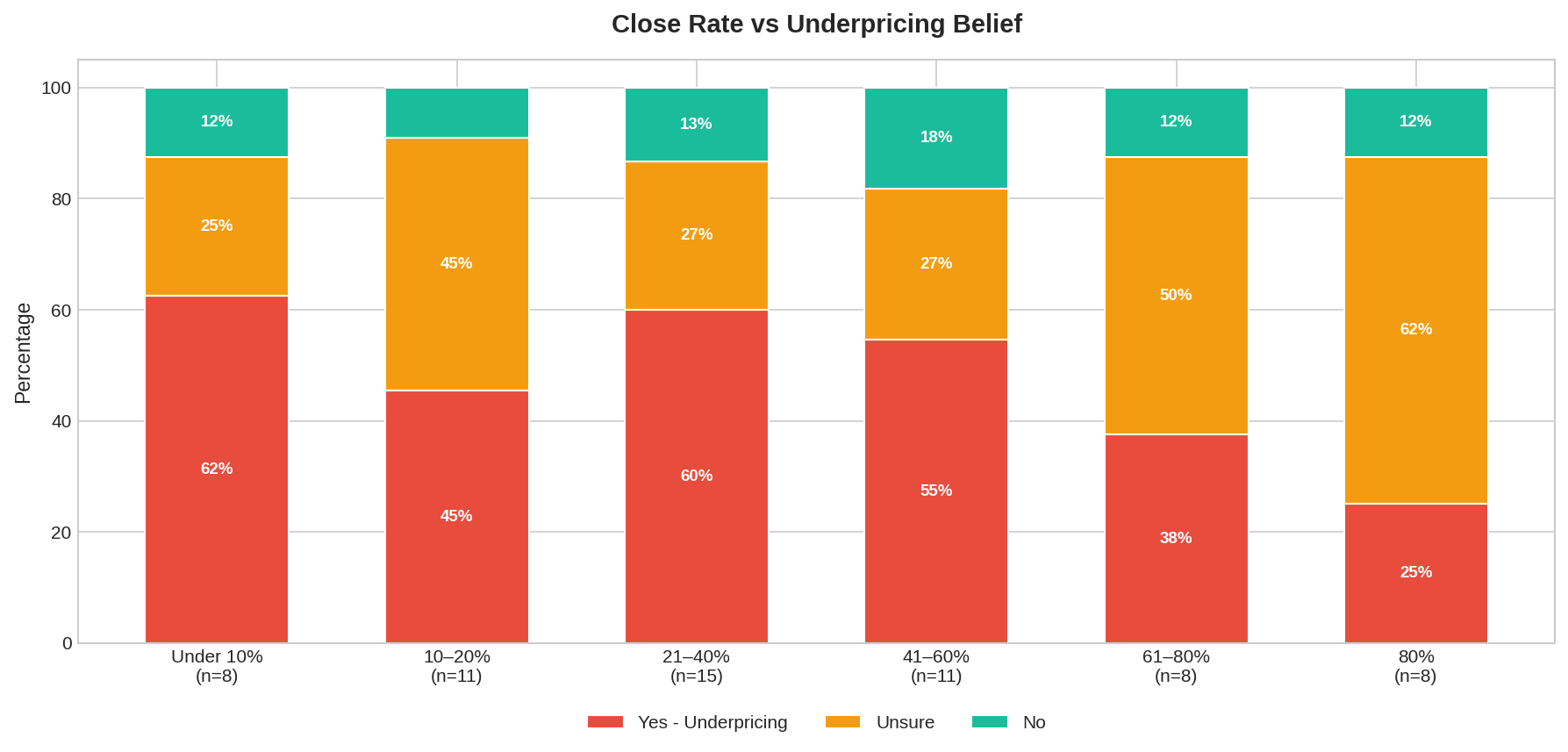

6. High close rates might be a warning sign

Conventional wisdom says a high close rate is a good thing. You’re winning deals, and clients are saying yes.

But what if too many yeses is the problem?

In the chart below, look at respondents with 80%+ close rates. Only 25% believe they’re underpricing—the lowest of any group. It sounds healthy, but you should also note that 62% are unsure. According to my data, 50% of them want to increase rates by 50% or more.

They’re not confident they’re priced right. They’re just not losing deals.

That’s a different situation. When almost everyone says yes, you’re probably not testing the ceiling. You’re staying safely below it. The market is telling you something, but it’s easy to misread the signal.

Compare that with respondents who close 21-40% of their opportunities: 60% believe they’re underpricing. They’re getting pushback, and it’s making them question their rates. Sometimes, friction is useful information.

Why do high close rates happen in the first place? Usually one of three reasons:

- You’re underpriced

- You’re only pitching warm referrals who already trust you

- You’re unconsciously screening out clients who might push back

All three feel comfortable in the moment, but they prevent you from discovering what the market would actually pay.

|

💡 What to do? Keep increasing your rates till you hit a ceiling. Your ideal close rate should be between 20% and 30%.

Because if everyone’s saying yes, how are you going to continue delivering at scale to hit your ambitious revenue goals? This also gives you an incentive to stop playing the volume game and focus on higher-quality Lighthouse Clients. |

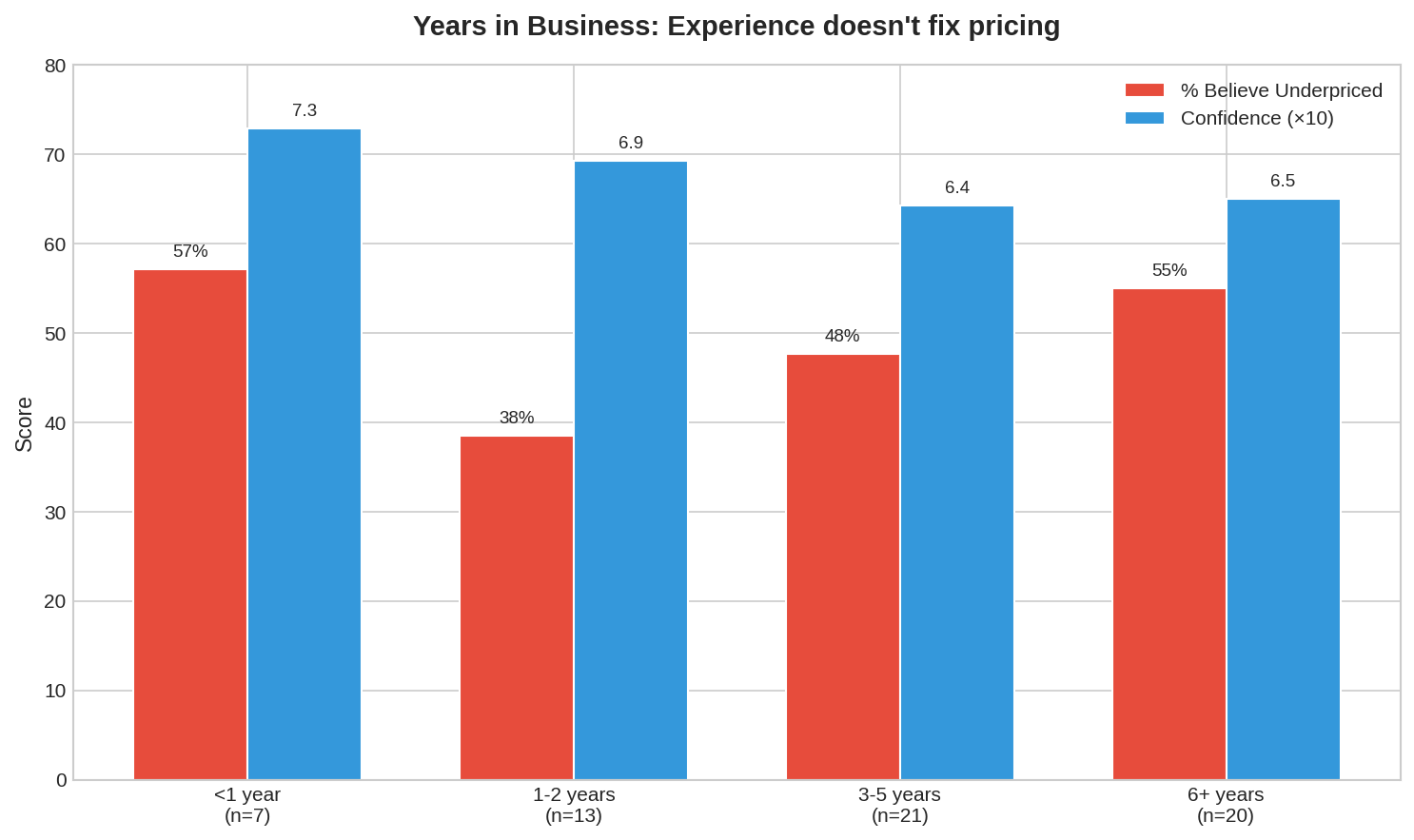

7. Experience doesn’t solve the pricing problem

You’d think time in business would bring pricing clarity. These solopreneurs have more reps, more data, and more confidence.

But the numbers say otherwise.

Solopreneurs with 6+ years of experience reported a 55% underpricing belief—higher than those with 3-5 years (48%) or 1-2 years (38%). “Veterans” aren’t more settled. They’re more aware of the gap.

Confidence doesn’t climb with tenure either. The highest average confidence was among those in business for less than a year (7.3). The 3-5 year group averaged just 6.4.

What’s happening? Early-stage solopreneurs often have the confidence of inexperience. They haven’t yet discovered what they don’t know yet which makes it easier to believe they’re doing something right.

And the fact of the matter is, they probably are. Most of them are starting from scratch after leaving their in-house role or just testing the waters while upskilling. Any demand they’ve validated is a vote of confidence.

But for the more experienced solopreneurs, that’s not the case. They’ve seen enough to recognize the opportunity cost of the years they spend underpricing their services.

Experience teaches you what you’re worth. It doesn’t automatically teach you how to capture it.

Experienced solopreneurs have more to lose. They’ve built a client base, a reputation, and a rhythm that works, even if it’s capped. Raising prices feels like risking everything. The longer you’ve been in business at a certain rate, the harder it is to change, even when you know you should.

|

💡 How to fix this? Use experience as leverage. Frame your pricing around the shortcuts you provide—for example, fewer mistakes, faster results, and pattern recognition that only comes from reps.

Clients aren’t paying for your time. They’re paying to skip the learning curve. |

8. Most raised prices recently and plan to do it again in the next 12 months

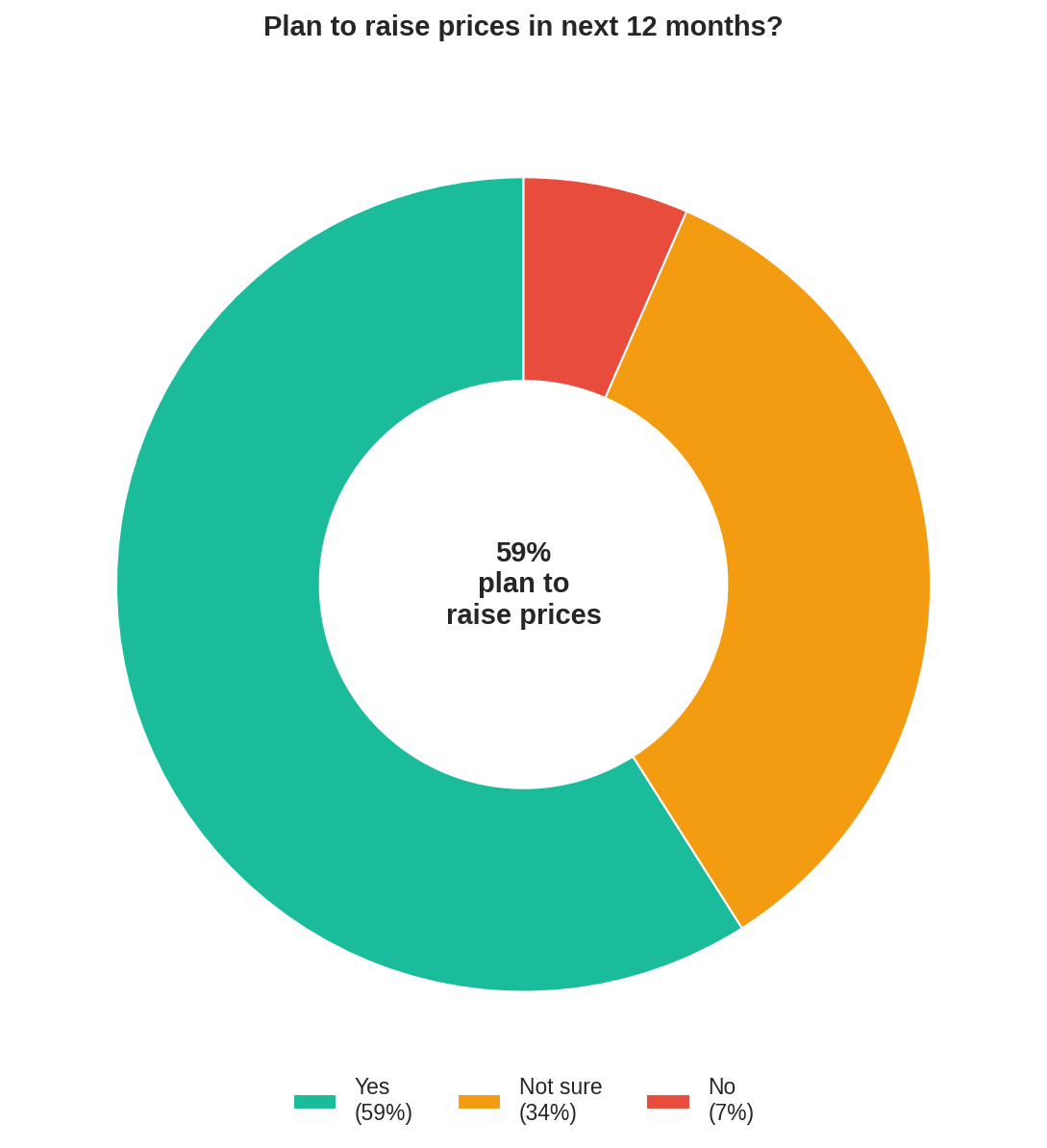

77% of respondents raised their prices within the past year. That’s not a group afraid to act. But one increase isn’t closing the gap.

Among those who raised prices in the past 12 months, 62% plan to raise prices again in the next 12 months. They moved the needle, and it wasn’t enough. As they upskill and build more social proof, it makes sense to update their pricing to reflect that change.

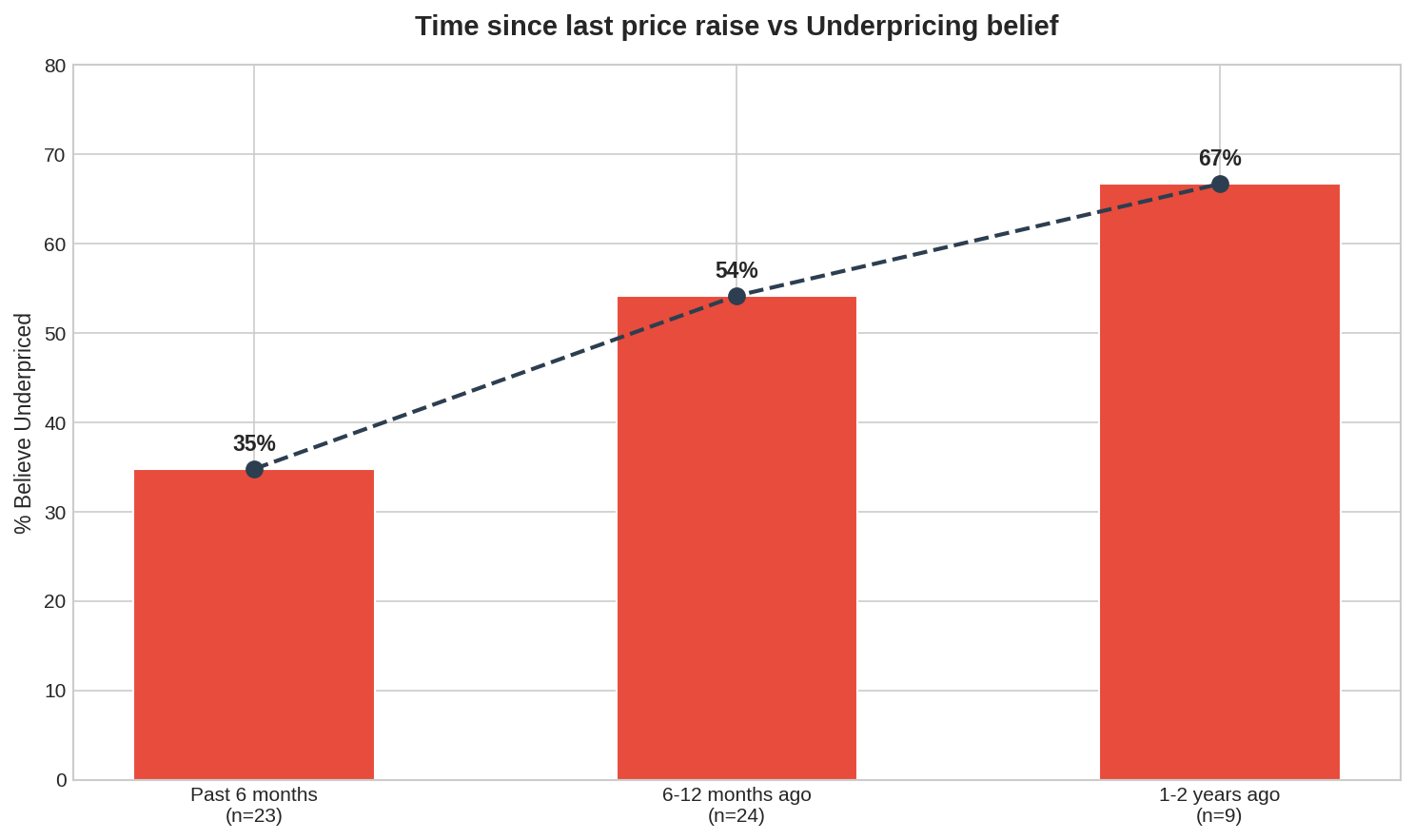

However, the timing pattern is telling. Those who raised within the past 6 months? Only 35% believe they’re underpricing. Those who raised 6-12 months ago? 54%. Those who haven’t raised in 1-2 years? 67%. The further you are from your last increase, the wider the gap.

You either get into the rhythm of keeping your rates as is, or you become afraid to increase them in case you lose clients or prospects. It’s one of the reasons 41% of solopreneurs aren’t sure about increasing their prices or don’t want to do so in the next year.

The survey also found 62% of solopreneurs haven’t raised their pricing in the last six months. It’s something I see all the time. They treat pricing as a one-time decision and forget to iterate over time. It’s not just about keeping up with inflation, but it’s about keeping pace with their own growth.

|

💡 How to fix this? Build pricing reviews into your quarterly reviews. I recommend revisiting your rates every 3 months.

It’s not necessarily about raising them, but about asking: Has my expertise grown? Have I added case studies or testimonials? Am I attracting better clients than before? If yes to any of these, your pricing should reflect it. Don’t wait until it “feels right.” Schedule it as you would any other business review. |

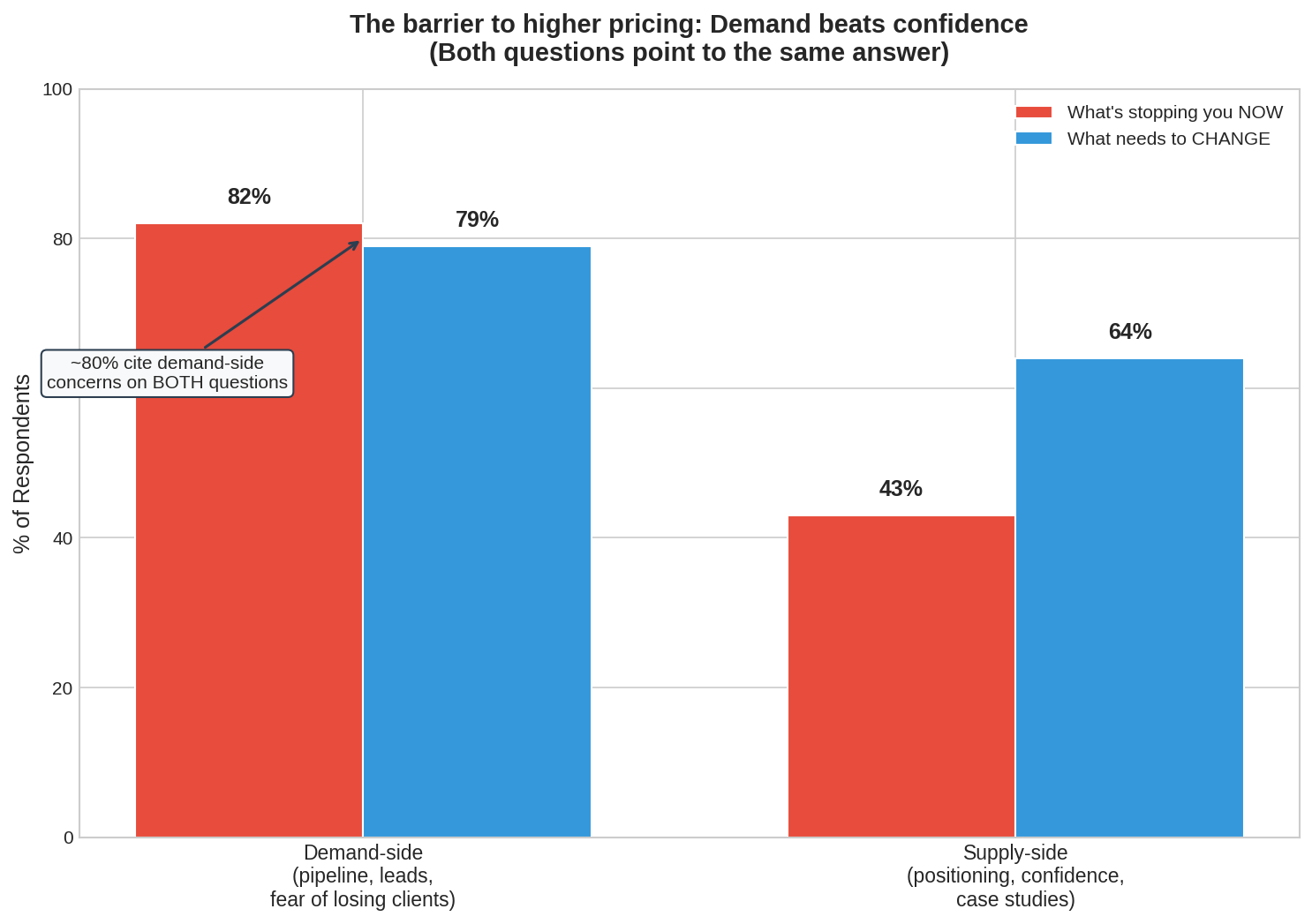

9. The real barrier isn’t confidence—it’s service demand

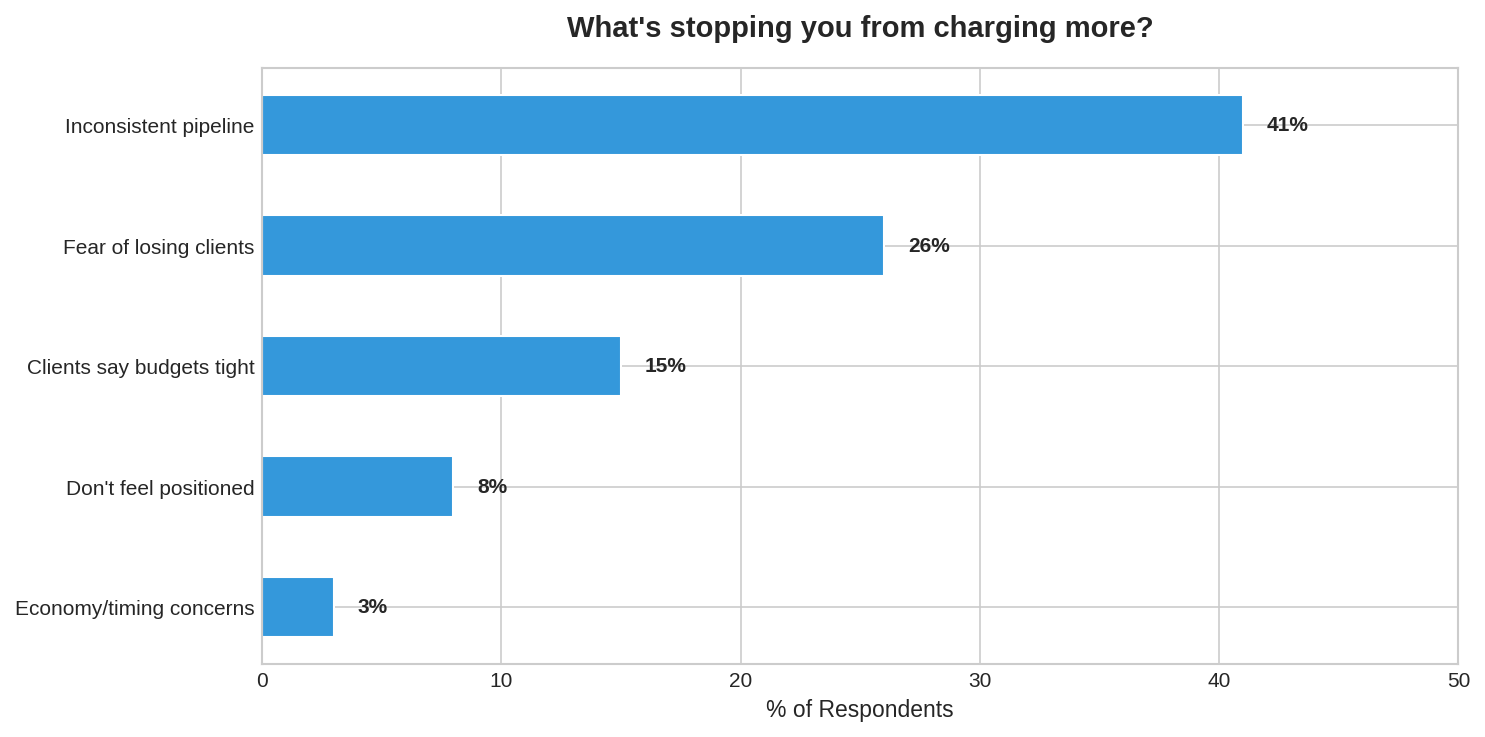

I asked two questions: what’s stopping you from charging more right now, and what would need to change for you to charge what you actually want?

The answers to both these questions point in the same direction. They’re struggling to create and capture demand for their service.

Here’s what that looks like:

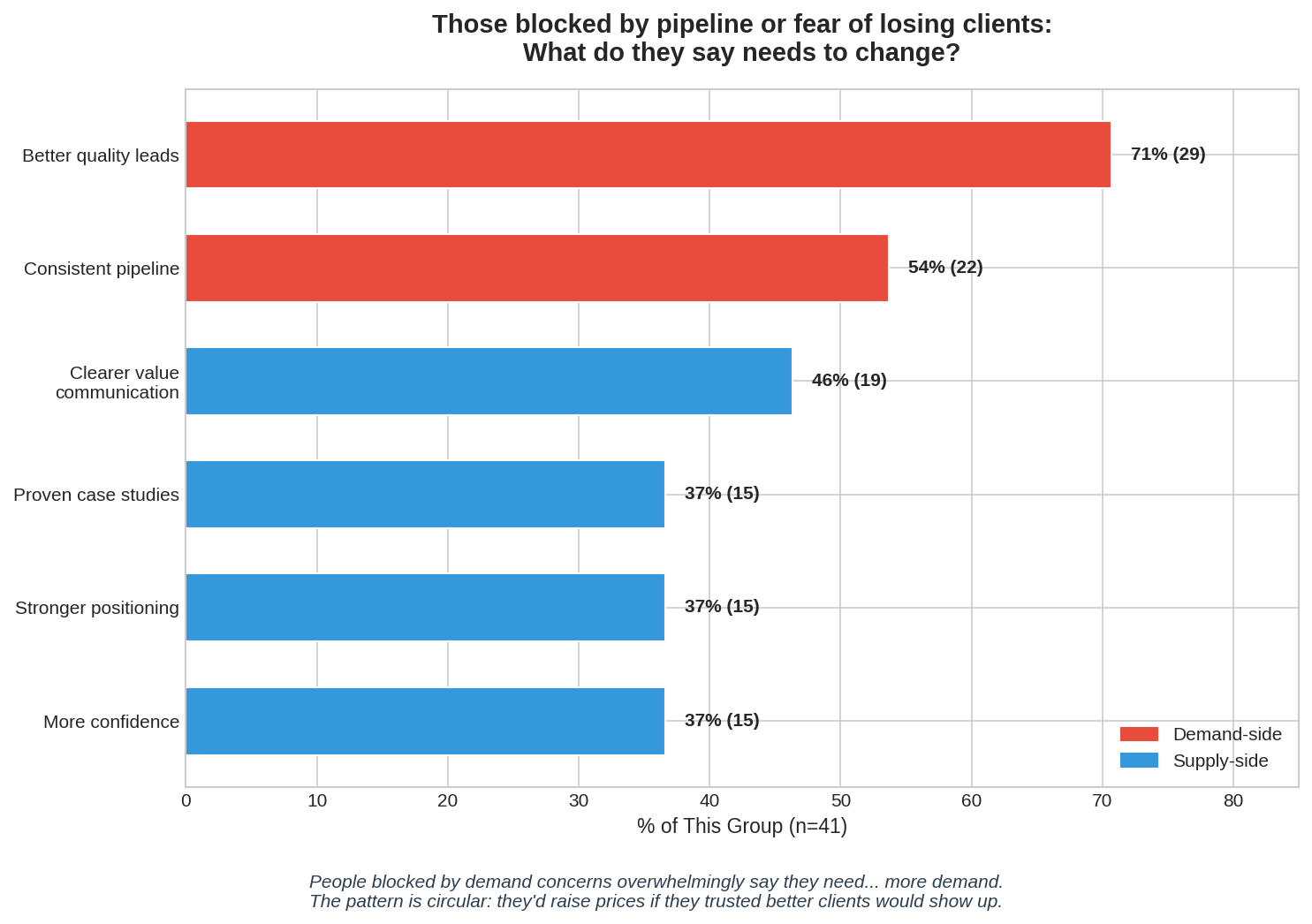

To understand this better, I looked at the respondents who cited either “inconsistent pipeline” or “fear of losing clients” as a current blocker. What did they say needs to change? 71% said better quality leads. 54% said consistent pipeline. 46% said clearer value communication. 37% said proven case studies.

The pattern is circular. They’re not raising prices because they’re worried about demand. And the thing that would unlock higher prices? Stronger demand.

This isn’t a confidence gap. It’s a leverage gap. They’d charge more if they trusted that better clients would keep showing up. But they don’t have that trust yet—so they price conservatively, close what they can, and stay stuck.

Most solopreneurs aren’t frozen by self-doubt. They’re frozen by the question: What happens after I raise my rates?

|

💡 How to fix this? You can’t fix a demand problem with pricing tactics. If pipeline anxiety is what’s holding you back, that’s the real problem to solve. Focus on three things: 1. Diversify your lead sources so you’re not dependent on referrals alone. 2. Build positioning that attracts clients who can afford premium rates, not just anyone who needs your service. 3. Create a repeatable system for generating conversations—whether that’s content, outbound, or partnerships. Once demand feels stable, pricing decisions get dramatically easier. |

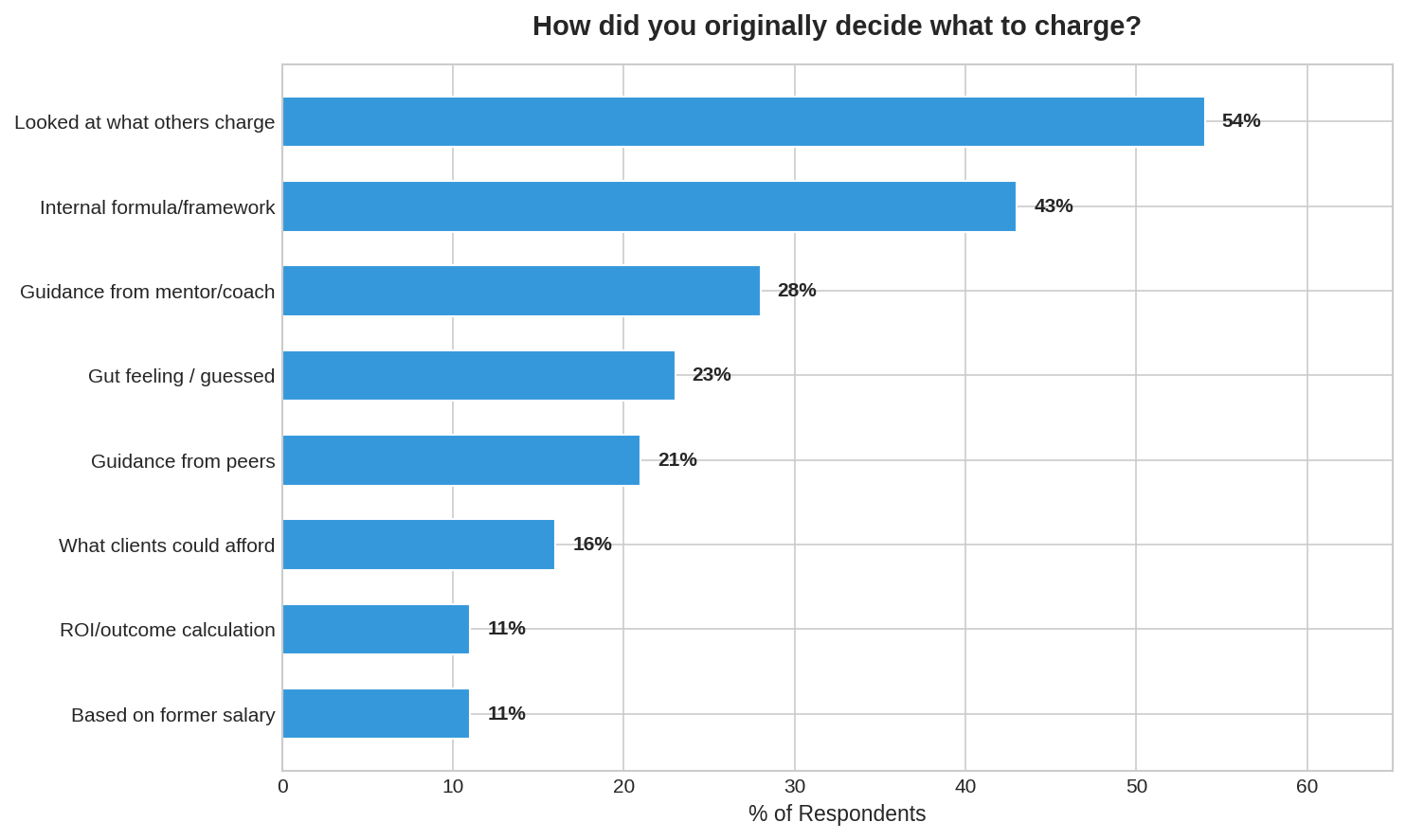

10. Pricing decisions start with comparison and stay reactive

When I asked solopreneurs how they originally decided what to charge, the top three methods were:

- Looking at what others in the field were charging

- Using an internal formula or framework

- Getting guidance from a mentor or coach

But fewer than 1 in 8 priced based on the outcomes they deliver. That’s not surprising—but it explains a lot. When your price is anchored to what others charge, you inherit their limitations. When it’s anchored to value created, you set your own ceiling.

You never know what’s going on in your peers’ businesses or how they structure their offers to protect their margins. Maybe they’re just more inexperienced, have forgotten to update their public rates, or their target market is influencing their rates. This is especially true when solopreneurs are testing demand for new services in private, while their public positioning is drastically different.

You’re treating guesswork like it’s a validated assumption and using that to set your own ceiling. That’s the opposite of what I recommend.

Set your rates based on your experience, outcomes created, and the value the client gets. It’s not always about what they can afford or which model they use to pay.

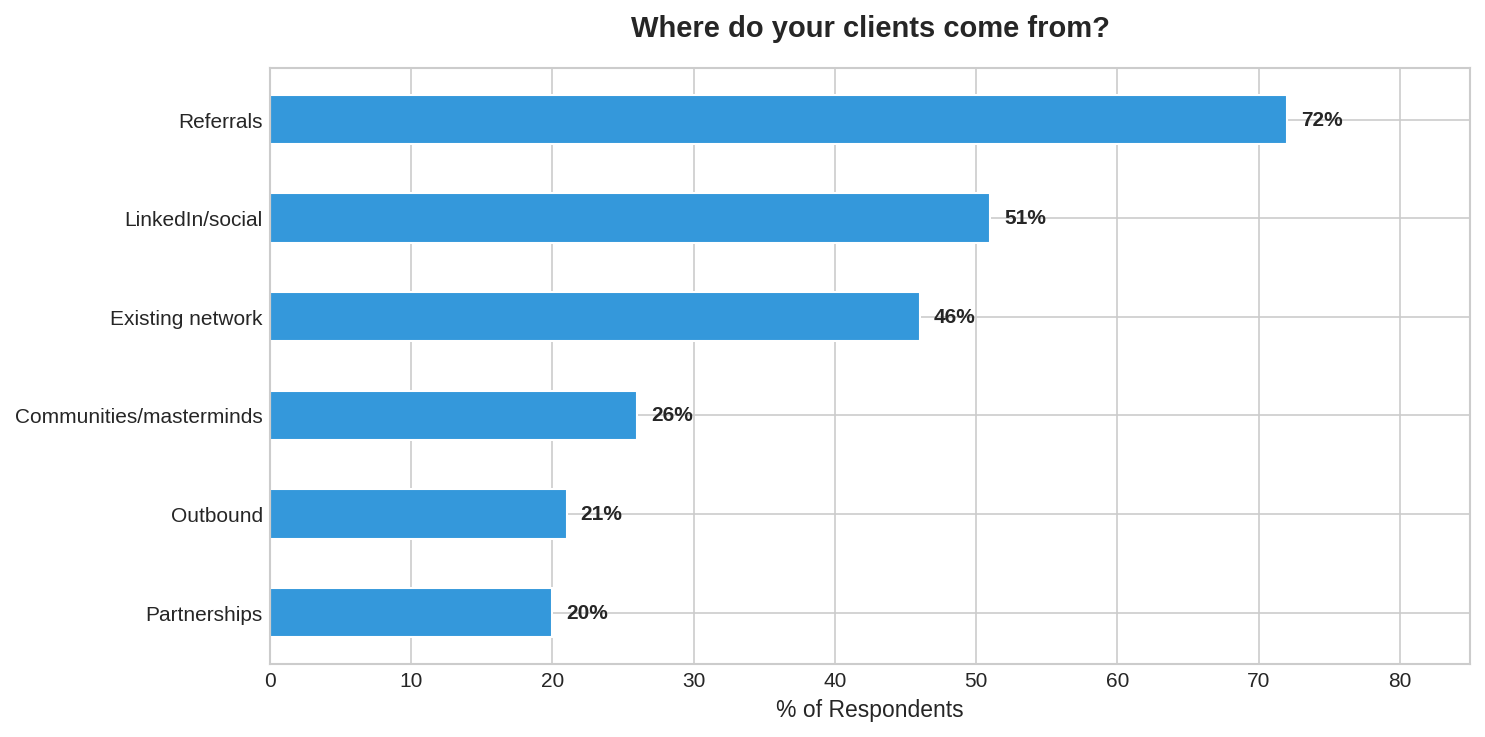

When it comes to the channel driver, 72% of respondents get most of their clients from referrals, 51% from LinkedIn or social channels, and only 21% from outbound.

Referrals feel good because they convert well. But they create dependency—and dependency feeds pipeline anxiety. Of the respondents who rely on referrals, half said “consistent pipeline” is what needs to change before they can charge more. In today’s market, you need to have more conversations, and relying on referrals to make that happen is a losing game.

In the past year, I’ve changed my motto from “More conversations, more sales” to “No conversations, no sales.”

It’s not just about volume, but with inbound channels drying up, you need to take control of your pipeline by using a mix of inbound and outbound tactics.

The channel that brings clients is also the channel that keeps them scared to raise prices.

|

💡 How to fix this? Shift from reactive to proactive pricing. Instead of anchoring to what others charge, anchor to the outcomes you create.

Ask yourself: What’s the financial impact of my work for a typical client? If you help a client win a $50K deal, close 20% faster, or avoid a costly mistake, that’s the basis for your pricing. Your rates should be driven by the value you offer. |

Where do you go from here?

The pattern across this data is consistent: solopreneurs aren’t held back by self-doubt. They’re held back by not trusting that better clients will show up if they raise their rates.

They know they’re undercharging. They’ve known for a while.

But raising prices feels risky when the pipeline is unpredictable. So they optimize for safety—lower rates, easier yeses, and high close rates that feel like wins but might be warnings.

The aspiration gap isn’t a confidence problem. It’s a demand problem dressed up as one.

If that’s you, the fix isn’t more mindset work. It’s building the demand engine that lets you test your ceiling without fearing the floor will collapse. You need better leads, clearer positioning, and a system to increase rates when the time’s right, not just when the year ends or it “feels right.”

You already know what you’re worth. The question is whether you’ve built a business that lets you capture it.

About the survey

This report is based on a survey of solopreneurs across my network, conducted in late 2025. Respondents included consultants, fractional executives, agency founders, coaches, and freelance specialists, primarily based in the US, with additional respondents from Canada, the UK, and Western Europe.

This is a directional snapshot of pricing sentiment among experienced service providers and not a statistically representative industry benchmark. Plus, the patterns have been validated across my work, helping 550+ solopreneurs with their offers, pricing, and systems.